GST can be defined as a destination based comprehensive tax levy on manufacture, sale and consumption of goods and service. It substitutes all indirect taxes levied on goods and services by the central and state government in India. It replaced multiple cascading taxes levied by the central and state government. The Centre and states would have simultaneous jurisdiction for the entire value chain. The GST tax will be levied on every value addition. It aims to fill the dodges in the current system thereby boosting the Indian economy and to eliminate the doubly taxation which leads to beneficial impact to the GDP growth of the country. The uniformity of tax and structures has left far-reaching impact on almost all aspects of the business operations in India and increased the efficiency in logistics.

GST has two components:

CGST (central goods and services tax)

2) SGST(state goods and services tax)

CGST is a central component of GST that subsumes all indirect taxes collected by the Centre. The tax collected under this component becomes revenue for central government.

SGST is a state component of GST that subsumes all indirect taxes collected by different states of India. The tax collected under this component becomes revenue for state government.

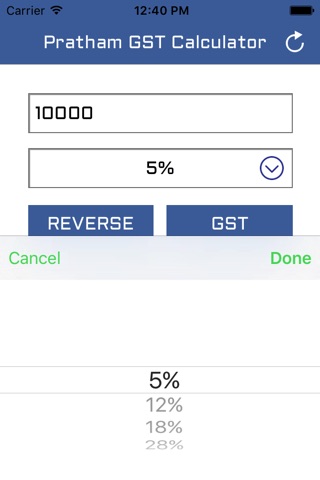

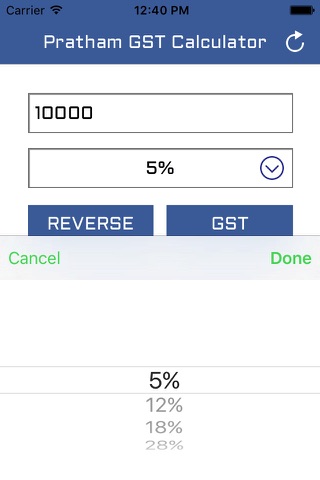

GST council has finalized rates for all the goods and major service categories under various tax slabs of 0%(zero rate), 5%(lower rate), 12% and 18%(standard rates) and 28%(higher rate).

This GST calculator app amenities for two functions:

GST reverse tax calculator: this function helps you to calculate the rate on actual GST rate.

GST calculator: this function helps you to calculate GST amount by choosing specific rate slab.

This calculator will show the actual amount, CGST amount, SGST amount and total amount. The peculiarity of this app is that it also calculates the decimal value other than various GST calculator apps in India.